Home Loan Interest Rates

Table of Content

Rates include discounts for TruStone Visa® Credit Card and automatic loan payment from a TruStone account. Actual rate for all loans based on an evaluation of applicant’s credit and payment history. The loan amount is based on an evaluation of the applicant’s credit and payment history, income and length of employment. Current TruStone auto loans are eligible for refinance with a minimum of $5,000 in additional disbursements. Fixed-rate mortgages have a consistent interest rate and monthly payment for the term of your home loan.

ING. This online bank is part of the global, Dutch financial group of the same name. You need to provide documents showing your current assets and liabilities . Here are the key features and details you need to know about Heritage Bank's mortgage products.

Transaction Accounts

HSBC. The local Australian banking arm of this international bank offers various home loans. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Finder.com.au is one of Australia's leading comparison websites. We compare from a wide set of banks, insurers and product issuers. We value our editorial independence and follow editorial guidelines. Maximum LVR is set at 95% for this loan, enabling borrowers to invest in a purchase even with a small deposit (less than 20% of the purchase price).

Heritage Bank home loans are available through brokers who can help find the right loan and manage your application at no charge. Offers financing for those looking to purchase or refinance a home with a higher price tag. With one Internet search, you can access a wealth of information on mortgages and refinancing. It’s empowering, but it doesn’t mean you’re on your own. Save on your investment loan with these hot offers.

Mortgage Loans (Purchase)

TruStone Financial loans provide the financing you need to achieve your goals while saving you money with competitive rates. See our full rate sheet and fee schedule for more information. Hi, i wondering if heritage bank provide home loans for newstart clients?

Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Personal

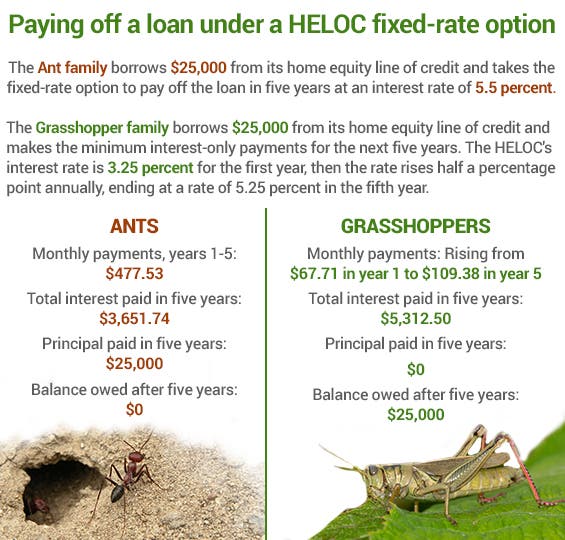

The Heritage Home Program℠ Loan is a low-interest fixed-rate home equity loan for homeowners to affordably maintain and improve their older houses. Contact one of our bank locations or apply online today. A second mortgage program allows you to use your home equity for home improvements, debt consolidation, etc.

Please refer to Wealth and Personal Banking Fees and Charges. Buying a property is a big decision and people need to be confident they are getting the best finance advise available. I work closely with my clients to understand their situation in detail, before selecting the best lender or lenders for them. Working in total independence of the banks, I have up to 50 lenders to choose from. Every one of my clients is unique and typically each require a different lending solution!

How do I apply for a mortgage from Heritage Bank?

Im looking to buy a home for around 300 thousand dollars and have $178,000. I wish to put down $158k and use the remaining on stamp duty and other expenses. Please let me know if there is any way this could work. Heritage Bank is committed to putting "people first" with fixed-rate home loans that offer stability and peace of mind. Heritage Bank offers a range of home loans for Australian borrowers. Check out the full table of Heritage Bank products below or read more about the lender.

Heritage Bank has home loan rates starting from 4.74%. The lending institution will determine whether the applicant is conditionally approved. Remember to include estimates from chosen contractors with the completed application. If you need assistance finding contractors or selecting estimates, Heritage Staff can assist you.

To meet the criteria, home-loan applicants who aren't already Heritage Bank customers have to be permanent residents in Australia. A Heritage Bank home-loans specialist will provide assistance. If you would like to apply for a home loan from Heritage Bank, please speak to a mortgage broker or speak to Heritage Bank directly. Once the fixed term of a loan ends, borrowers can start another fixed-rate cycle at no extra cost.

By providing you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. David is also a champion for new products to better serve our local market. Providing customers options goes beyond presenting what’s currently possible. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice.

Comments

Post a Comment